Tax Benefits of Long-Term Care Insurance

Always consult a professional tax advisor for your specific situation. Generally speaking, tax-qualified Long-Term Care Insurance policies do have important tax advantages.

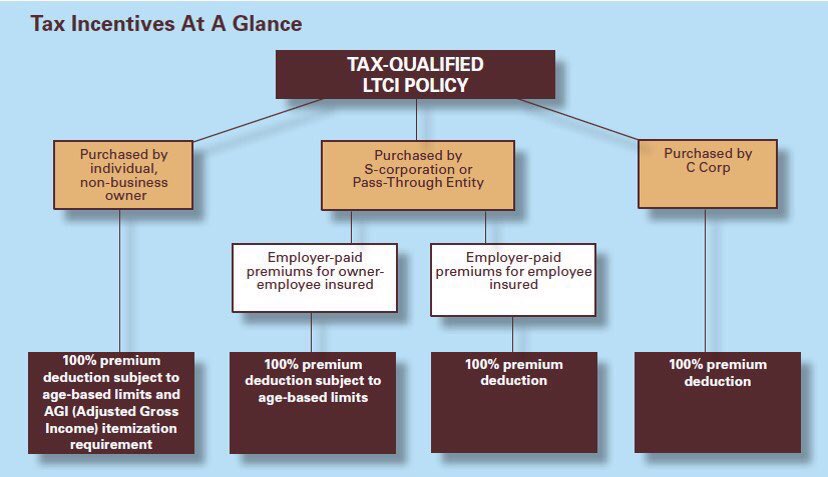

The Health Insurance Portability and Accountability Act of 1996 (HIPAA) included provisions for the favorable tax treatment of qualified Long-Term Care insurance. This includes individuals as well as small and large businesses (S-Corporations, C- Corporations, LLCs, partnerships, and sole proprietors).

For C-Corporations, the total premium is deductible as a business expense. Consult your tax advisor for details.

In addition, individuals with a Health Savings Account can use the pre-tax money in their HSA to pay or reimburse themselves for LTC insurance policy premiums. Do not confuse the Flexible Spending Account or FSA with HSA. The FSA is a tax-advantaged benefit program established by employers for employees’ qualified health related expenses. Unlike the Health Savings Account (HSA), the FSA is a use it or lose it account and long-term care insurance is NOT an eligible expense.

An HSA holds money you get to keep, and long-term care insurance premiums are an eligible expense. Any money left over in these accounts at age 65 gets converted to an IRA.

Tax-qualified Long-Term Care Insurance premiums are considered a medical expense. For people who itemize their tax deductions, medical expenses are deductible to the extent that they exceed the current amount required to meet their Adjusted Gross Income (AGI). The amount of premium that can be treated as a medical expense (and therefore deducted) is limited. The eligible amount is defined by Internal Revenue Code 213(d), and is based on the age of the insured individual(s). The portion of the premium, if any, that exceeds the eligible premium is not included as a medical expense.

Individual taxpayers can treat premiums paid for tax-qualified long-term care insurance for themselves, their spouse/partner or any tax dependents (such as parents) as a personal medical expense.

The yearly maximum deductible amount for each person is based on the person’s attained age at the close of the taxable year (see table for current limits). These deductible maximums are indexed and increase each year for inflation. Some people may not qualify for a tax deduction when they are younger, but may become eligible as they age.

Long Term Care Insurance Federal Tax Deductible Limits

| Age Bracket | 2024 Limits | 2025 Limits |

| 40 and under | $470 | $480 |

| 41 - 50 | $880 | $900 |

| 51 - 60 | $1,760 | $1,800 |

| 61 - 70 | $4,710 | $4,810 |

| 71 and older | $5,880 | $6,020 |

Some States Offer Tax Deductions or Credits

In addition to the federal tax incentives that are available, many states offer tax benefits as well. To see the current tax benefits in your state, click here to visit our information by state map.

Please note, always check with a qualified tax advisor to be sure rules have not changed.